3 pillars of knowledge in stock investment

1) System. How the trade is done.

2) Products. What to buy under different market condition

3) Market Knowledge. Stock markets are moved by Buyers and Sellers.

1) SYSTEM

Without knowledge of the system, you will not be able to know how to invest in stock.

To begin, you need to have CDP account and trading account.

Why? CDP account is required to keep shares you bought

Trading account is required to buy and sell shares . You may opt for online trading, still you need a securities firm to allow you to buy and sell shares. You need to open CDP account and trading account.

How ?

Visit CDP at SGX Centre 2 Level 2 , address is 4 Shenton Way. This is beside Lau Pa Sat. Visit CDP webiste at www.SGX.com/CDP to learn more details.

Request to open CDP account. Best to provide Bank account number. In future, should there is stock that give cash dividend, CDP will credit direct into your Bank account instead of you receive cheque.

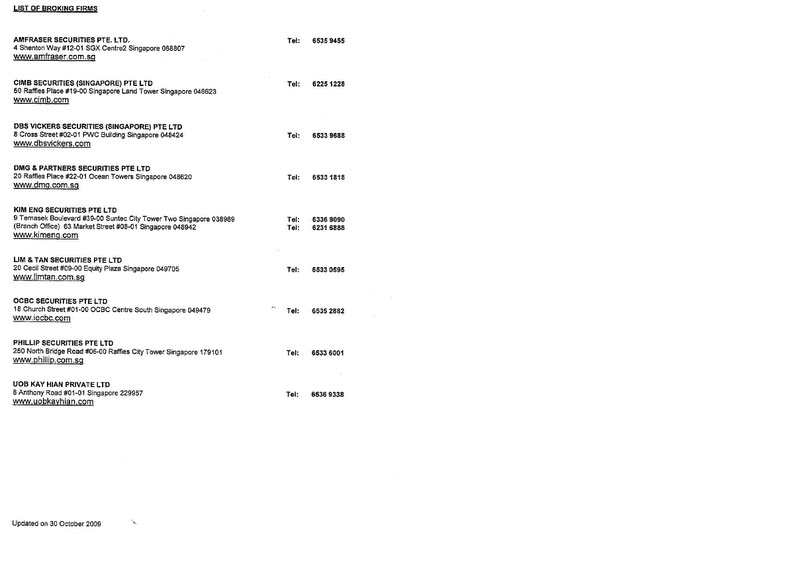

After CDP account open, you may visit any of the securities firm to open trading account. CDP will provide you with a list of securities firm.You may find broker you like to open trading account. Broker, Remisier, dealer, Trading Representative as title given to them. You are allow to open more than one trading account.

To find List of securities firm members

They will advise you and provide the service to buy or sell stock. If you prefer to use online trading, you may register and buy and sell share on your own. Commission charge for brokerage service is 0.5% or minimum $40. Online trading commission is 0.275% or minimum $25.00

After CDP account and trading account are ready, you may deposit fund to buy stock or sell stock.

If you are Singaporean, you are entitled to Credit Limit. Securities firm will give you credit limit according to your background based on the account opening application form.

You will be able to buy stock even before you deposit fund into the trading account. The amount you can buy depend on the credit limit given to you. Example if you are given $20,000 credit limit, you can buy stock value worth $20,000.00 but not more than $20,000.00

The settlement date for buying a stock T+3. This means you are given 3 days grace to make payment.

Example , if you buy stock on Monday, you can make payment on Thursday.

Various mode to deposit fund

1) Cash / cheque. You can mail your cheque to pay the purchase of stock.

2) ATM 's other service , EPS, You can do fund transfer using your ATM card.

3) Internet banking Bill payment. You can do online fund transfer to pay.

Note the affiliated banks available are DBS, OCBC, UOB, Citibank,

CONTRA

if you buy stock and sell stock before settlement date , you need not pay the buy stock amount, the securities firm will contra the trade.

You will either have contra profit or contra loss.

You are required to pay on the settlement date for contra loss.

For contra profit, you will receive money the next day after settlement date into your bank account.

If you do not provide bank account number, a cheque will issue to you.

Bank account is not necessary but is more convenience.

Another service is GIRO. on the settlement date, will deduct money from your bank account automatically.

Contra trade is very lucrative as you need not put up any capital and market move in favour of your trade, you actually make money without capital. You return on stock investment is infinite.

However, there is a risk that the stock market may move against you, you will face contra loss.

This is especially so when people has $50,000 credit limit for their trading account.

3 days grace to make payment is attractive to many people who want to make money with no money.

Buying stock with no money to pay is considered failed settlement of trade. Forced sell is done. You will have to face penalty and higher commission charge.

Error trade to sell more than you have. Oversold the number of shares. You will be penalised. Buy-in is done. SGX will charge you short selling.

2) Products

Visit SGX website under Market Information to learn about various products.

Some common products are Stock, Fixed income, Reits, ETF, Structured warrant

Stocks are the share of company to buy and sell with introduction of warrants to allow you to protect your shares.

Fixed Income are Bond, Preference shares, SGS (Singapore Government bond)

REITs is Real Estate Investment Trust where investors can invest in property with minimum amount.

Structured warrants are more sophiscated as there are more flexiblility.

Specified Investment Products from http://www.sgx.com/wps/wcm/connect/73978e8047c07fa3b496bf4ccca6d8ff/20110728_SGX_Online+Edu+Flyer+HR.pdf?MOD=AJPERES

Specified Investment Products. Investors are required to attend online module to buy sophisticated products.

Click below to register.

https://onlineeducation.sgx.com/specifiedinvestmentproducts/user_register.asp

3) Market knowledge.

US stock market.

US central bank : Federal Reserve Bank (Fed)

Interest rate movement

Stock, bond, oil, gold, all are inter related.

Visit financial website to learn about current news

http://www.finance.yahoo.com/

http://www.money.cnn.com/

http://www.bloomberg.com/

Market History is important as market are formed by human being greed and fear.

History repeats.

The most important of the 3 knowledge is market knowledge.

Knowing and understand how and what move market is important.

After knowing the market and understand it movement, you will be able to identify profitable opportunity. The product knowledge and system knowledge helps to enhance your stock investment.

No comments:

Post a Comment